“An organization’s ability to learn, and translate that learning into action rapidly, is the ultimate competitive advantage.“ Jack Welch.

Banking, financial services, and insurance sectors continue to experience unprecedented volumes of regulatory change and complexity.

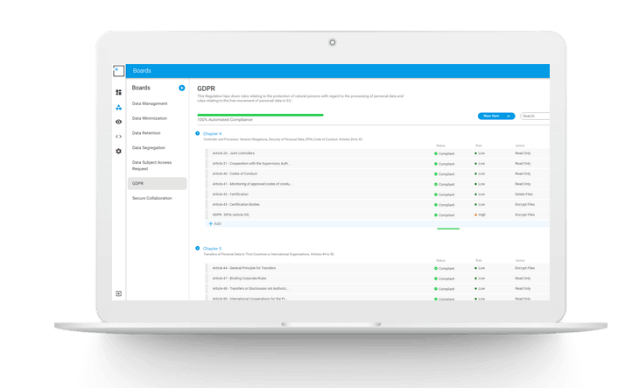

MinerEye leverages feeds of Regulatory Intelligence (RI) helps companies gather, monitor, and analyze regulatory data and track developments in a rapidly changing environment.

Leverages AI and ML to group huge volumes of file data in a variety of dimensions e.g. meta-data, content, risk, location, access permissions. Puts a risk score to every file for clear-cut prioritization for mitigation.